Form 7004 Download

Filing taxes can be daunting, but with the right information and guidance, you can make the process a breeze. One of the essential forms you need to be familiar with is IRS Form 7004. This article will provide a detailed guide on the importance of the form, how to complete it accurately, common mistakes to avoid, and potential penalties for failing to file or providing false information.

The Importance of the IRS Form 7004

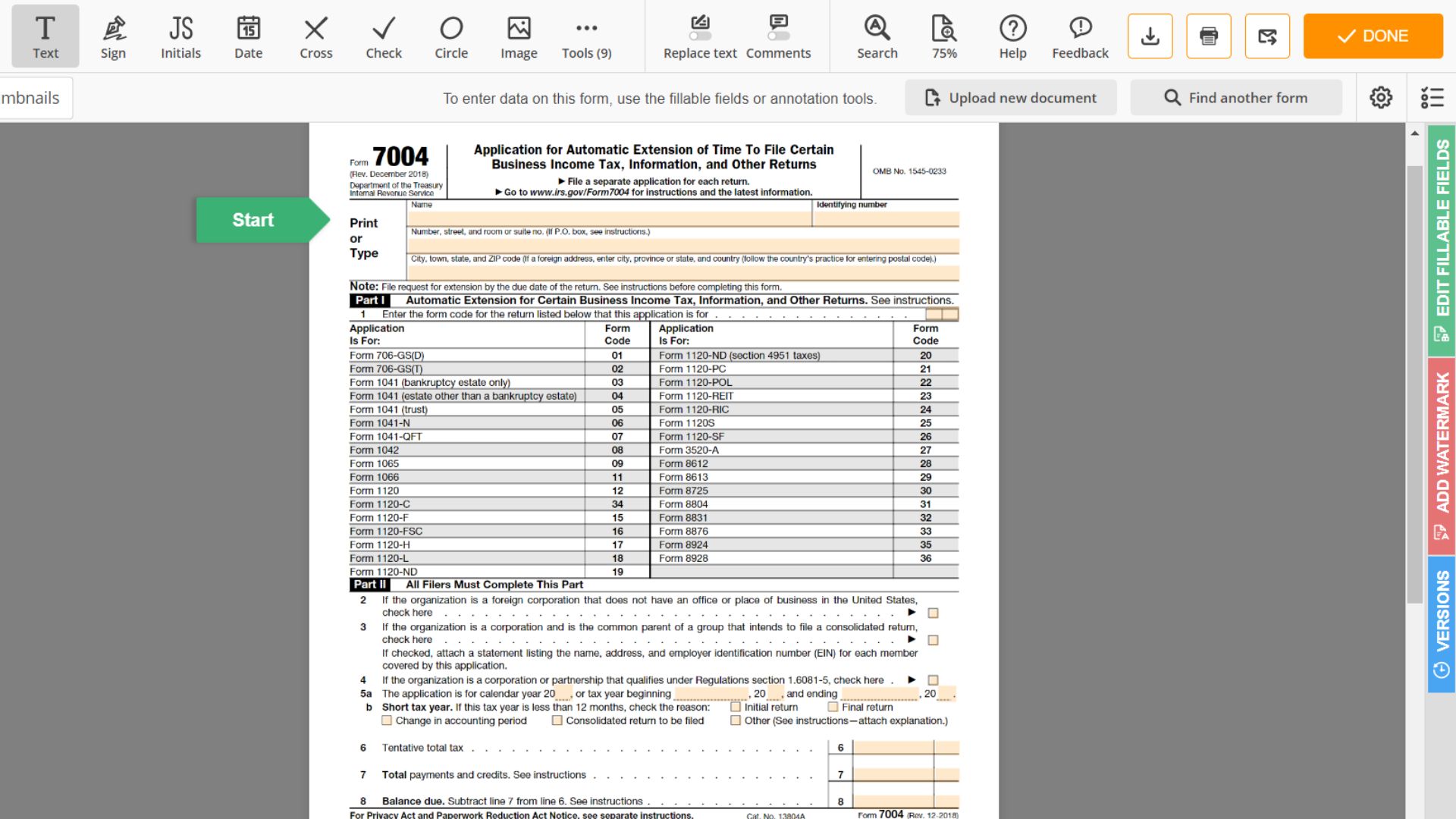

The IRS Form 7004, otherwise known as the "Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns," is crucial for businesses that need additional time to file their tax returns. By submitting this form, businesses can request an automatic extension of time to file their income tax returns, partnership returns, and certain trust and estate tax returns. However, it's important to note that this extension does not provide additional time to pay the due taxes.

How to Complete the Form with the Requested Information

To complete IRS Form 7004, follow these steps:

- You can download the form from the official IRS website or request a physical copy by mail.

- Provide your business's name, address, and employer identification number (EIN) in the designated fields.

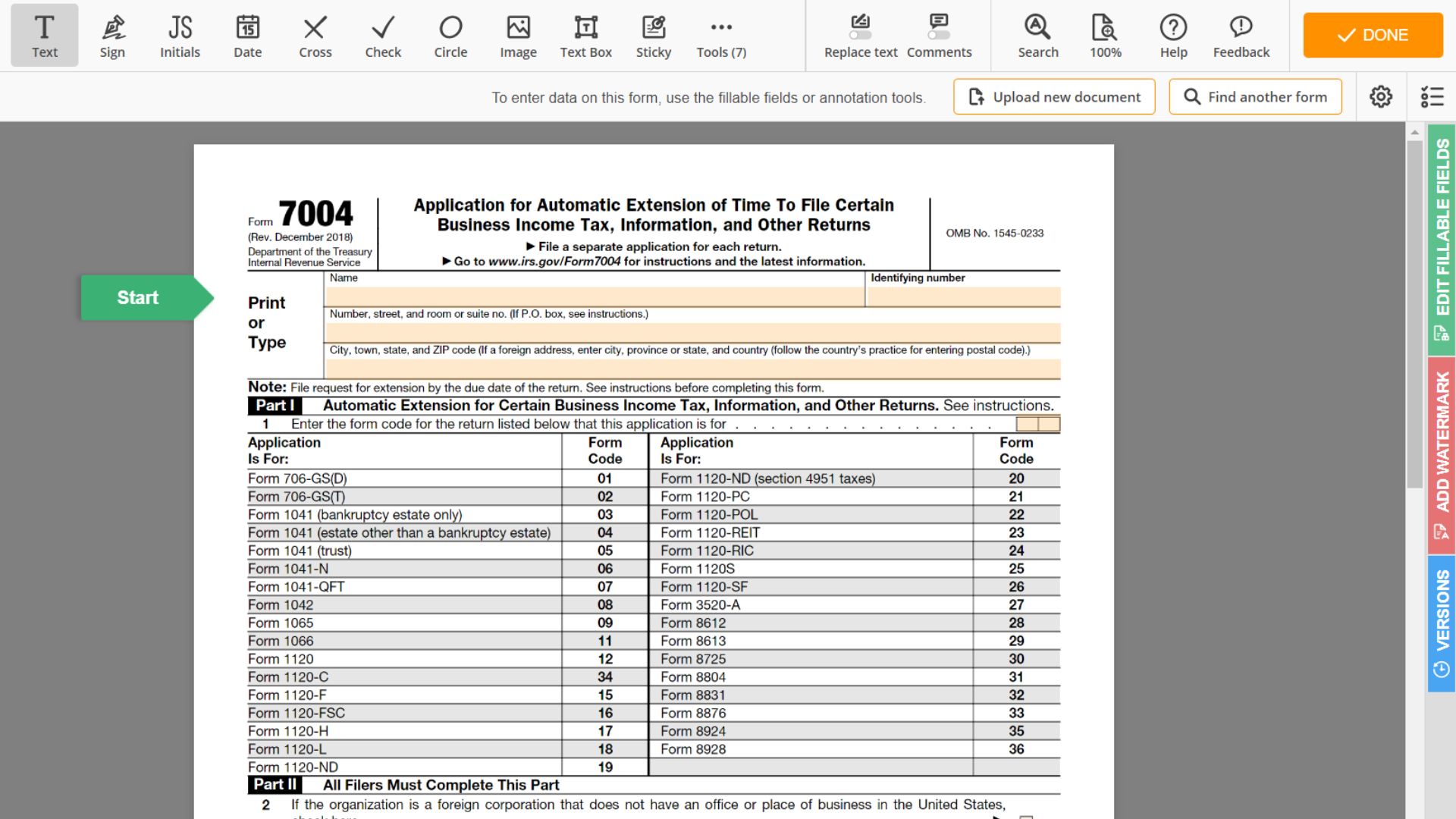

- Identify the tax return for which you're requesting an extension by entering the relevant form number and code in Part I, lines 1 and 2.

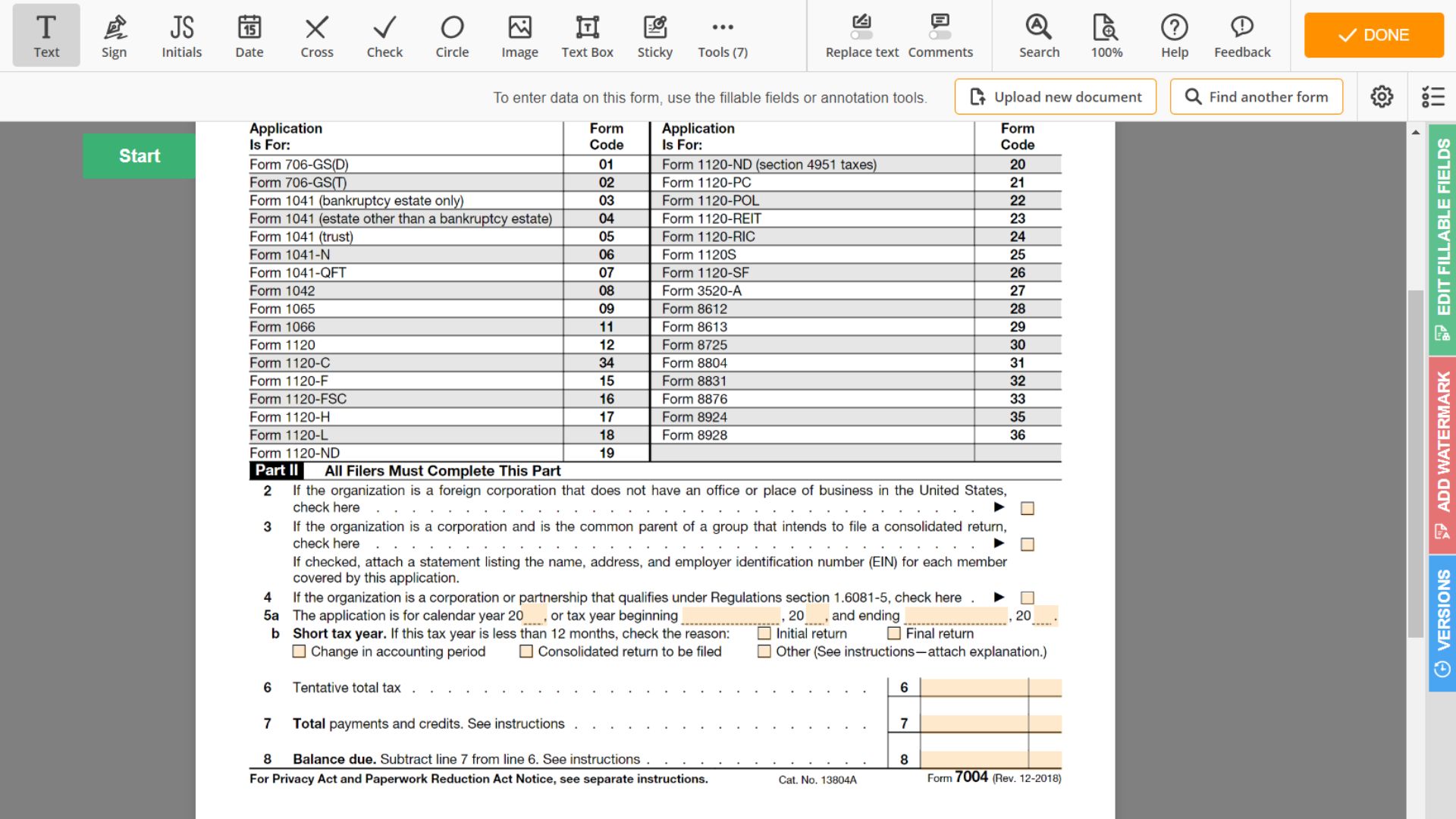

- In Part I, line 3, specify the number of months you're requesting for the extension, which will vary depending on the type of return you're filing.

- In Part II, lines 4 through 7, provide an estimate of your total fiscal obligations for the applicable tax year and any payments you've already made.

- Complete the form by signing and dating it, and provide your title if applicable.

Common Mistakes People Make Completing the 7004 Template

Avoid these common mistakes when filing IRS Form 7004:

- Failing to provide accurate and complete information, such as your business name, EIN, or address.

- Not selecting the correct tax return form number and code.

- Miscalculating the extension period or fiscal obligations estimates.

- Not filing the sample by the original due date of the tax return.

- Forgetting to sign and date the copy.

Possible Penalties for Failing to File or Providing Fake Data

Failing to file IRS Form 7004 or providing false information on the form can lead to various penalties, including:

- If you don't file Form 7004 by the original due date of the tax return, you may be subject to a late filing penalty, which is typically 5% of the unpaid tax for each month the return is late, up to a maximum of 25%.

- Even if you've been granted an extension, you may still be subject to a late payment penalty if you don't pay the taxes due by the original deadline. This penalty is typically 0.5% of the unpaid monthly tax, up to a maximum of 25%.

- If the IRS determines that you've provided false information on the form, you may be subject to a penalty of up to 75% of the underpayment due to fraud.