IRS Form 7004: Tax Extension for 2023

IRS Form 7004: File Business Income Tax Return Later

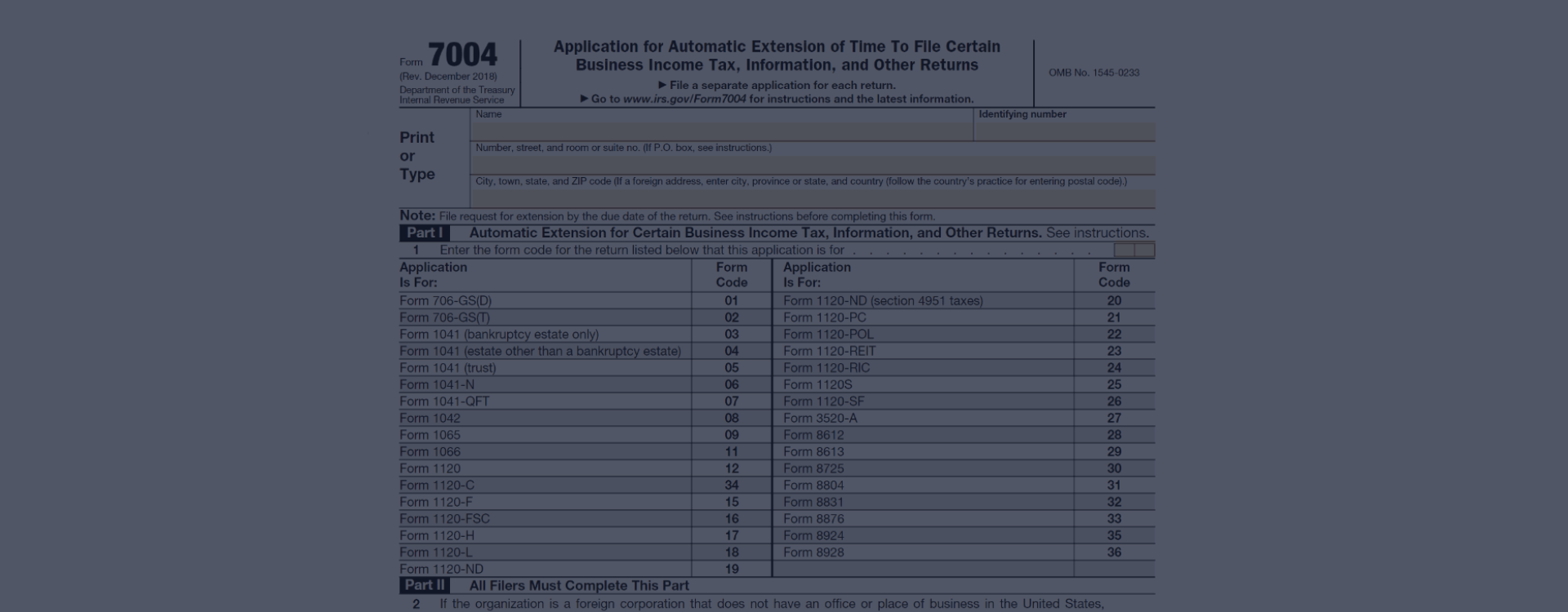

It’s an official document used by businesses and certain individuals in the United States to request an extension of time to file their federal tax returns. Federal tax form 7004 specifically applies to various business entities, including corporations, partnerships, trusts, multi-member LLCs, and certain estates. By submitting the application, taxpayers can request up to six months to prepare and file their tax returns without incurring penalties. However, it is important to note that filing IRS Form 7004 for an extension of time does not grant additional time to pay the taxes due, which must still be paid by the original deadline to avoid interest and penalties.

Get Relevant 7004 Tax Form Instructions & Examples

The website you visit - 7004-form.com - is a valuable resource for taxpayers needing assistance understanding and completing business tax extension form 7004. The website provides comprehensive instructions, examples, and other materials that can help guide users through the process of filling out the 7004 sample accurately and efficiently. By utilizing the information available on 7004-form.com, taxpayers can better understand the requirements and deadlines associated with federal tax extension form 7004 and the potential consequences of failing to do so. Additionally, the website's user-friendly interface and easy-to-follow guidance can make the often complex and daunting task of navigating tax forms and procedures more manageable and less overwhelming for taxpayers.

IRS Form 7004 for Businesses: Features & Using Terms

U.S. corporations such as partnerships, limited liability companies (LLCs), estates, and trusts that need an additional six-month extension to file their federal income tax returns must complete that document. The purpose of IRS tax form 7004 is to request an extension to file these specific income returns, enabling taxpayers to avoid potential late filing penalties.

For instance, let's consider a fictional person named John Smith, a successful entrepreneur who owns a thriving retail business in New York City. John's business operates as a limited liability company (LLC), a legal business structure providing him with limited personal liability for the company's debts and obligations. Due to the complexity of his business operations and the need to accurately report his financials, John requires the expertise of a financial professional to assist him with filing his federal income tax return.

Unfortunately, John's advisor experienced unforeseen circumstances this year, causing a delay in the preparation of his income tax return. To avoid any penalties associated with late filing, John must file IRS Form 7004 fillable or printable to request an extension for his LLC's income tax return. By filing this application, John will have an additional six months to gather all necessary documentation and work with his advisor to ensure accurate reporting of his business's financials to the Internal Revenue Service.

Prohibition on Federal Form 7004 Use

However, some exemptions restrict using IRS tax form 7004 for extension of time in specific situations. So check out if you’re not on the list of people who can’t fill it out.

Blank 7004 Template: Instruction to Fill It Out

Filling out the blank PDF correctly can be a straightforward process if you follow these IRS 7004 form instructions.

Here what you need to start:

- Find the federal tax form either online as a PDF file, or you can request a printable blank template from the IRS website.

- Before you start filling out the printable or fillable Form 7004, reading and understanding the provided instructions is crucial to ensure you complete it accurately.

- In Part I, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust.

- Fill in your business's name, address, and Employer Identification Number (EIN) in Part II of the printable or fillable template.

- In Part III, use the provided list to choose the tax form code corresponding to the return for which you request an extension.

- Estimate the financial obligations for the tax year and enter the amount in Part IV.

- Include any previously paid taxes or applicable credits towards your fiscal obligations in Part V.

- Calculate any amount still owed to the IRS and enter it in Part VI of the template.

- After completing all necessary sections, sign and date the 7004 example to finalize your extension request.

- You can print and mail the completed sample or file IRS Form 7004 online via the e-file system.

Similar IRS Forms

There are also other IRS forms with a similar purpose that might be helpful.

Date to File Form 7004

The due date to fill out IRS Form 7004 and submit is generally on or before the original deadline of the applicable tax return. For most businesses, this falls on March 15th or April 15th, depending on the type of business entity. The document enables businesses to request an automatic extension of time to file, giving them an additional six months to submit their complete annual declaration.

Federal Tax Extension Form 7004: Examples & Samples

IRS Form 7004: More Information for Businesses

Please Note

This website (7004-form.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.